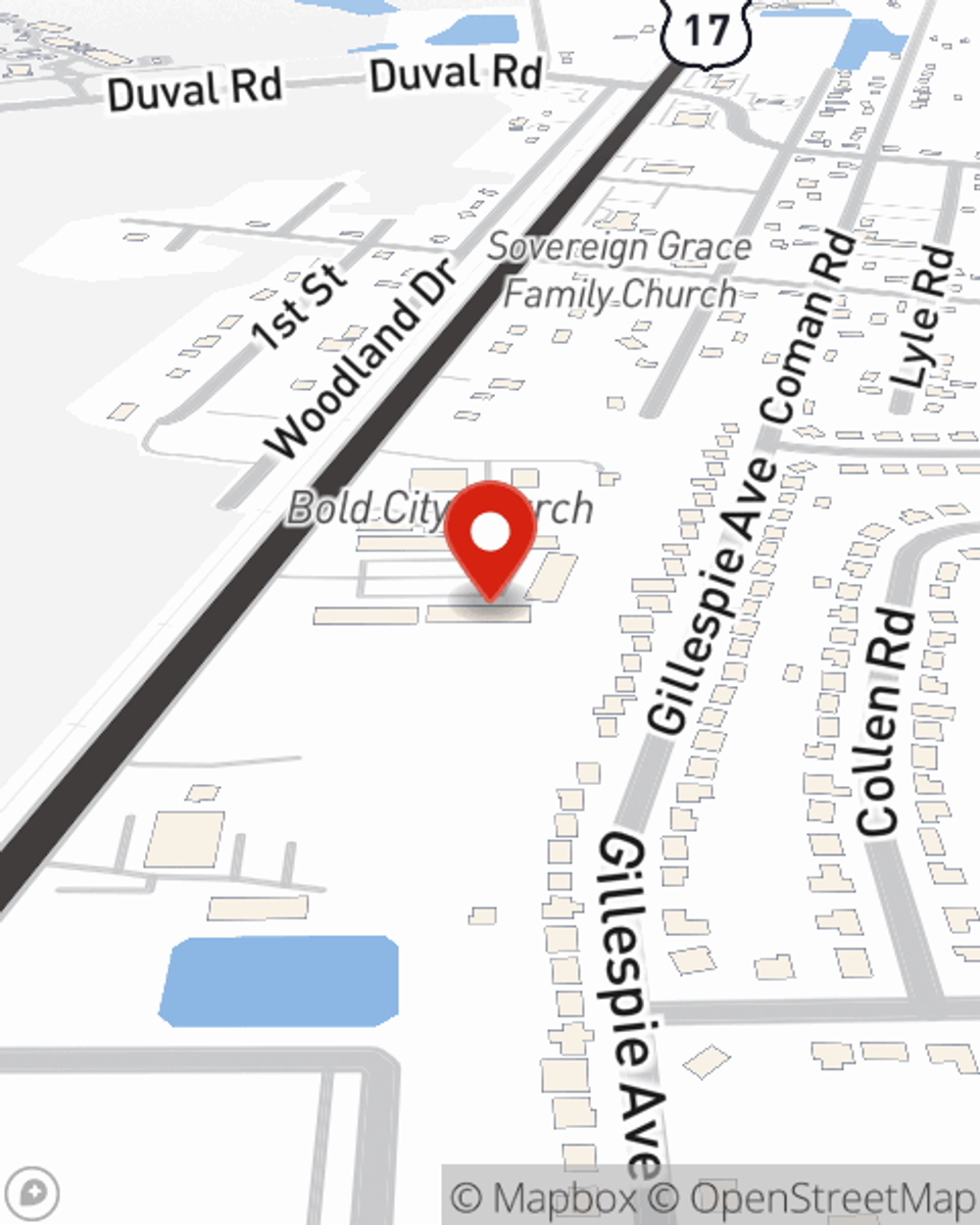

Business Insurance in and around Jacksonville

Calling all small business owners of Jacksonville!

Helping insure small businesses since 1935

- Jacksonville

- Duval County

- Nassau County

- St Johns County

- Yulee

- Fernandina

This Coverage Is Worth It.

Do you own a tailoring service, a pharmacy or an art gallery? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Jacksonville!

Helping insure small businesses since 1935

Protect Your Business With State Farm

When one is as passionate about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial liability umbrella policies, surety and fidelity bonds, commercial auto, and more.

As a small business owner as well, agent Stephanie Lempesis understands that there is a lot on your plate. Call or email Stephanie Lempesis today to learn about your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Stephanie Lempesis

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.